Building true wealth and prosperity is a common goal amongst the working class. We want to live a financially independent life, free of stress and compromise. Most people know what they are wanting to accomplish and can verbalize why their goal is important to them, but one of the biggest hurdles in implementing and developing a financially sound system is knowing how to make it happen. These strategies and foundational knowledge are not outlined in school curriculums and because most individuals are unaware of the possibilities, their children don’t receive this type of education at home.

The Infinite Banking Concept is a strategy that has been used for over a hundred years (and could be argued to be even older) by the wealthiest, most prominent individuals, families, and companies in the world. IBC has been renamed as “Becoming your own banker”, “Be your own bank”, “Bank on yourself”, etc. but the idea is always the same.

Instead of paying interest to outside entities for funding, recoup that interest, bring it back into your own pocketbook, and allow your money to maintain earning compound interest indefinitely. True Infinite Banking utilizes a specially designed, dividend-paying, cash value, whole life policy to take advantage of the IRS tax codes that protect the death benefit and cash values, as well as the guaranteed growth that is uncorrelated to the stock market.

When completely understood and properly set up, these policies take business and real estate returns to the next level. Yes, this is a life insurance policy so there is a mind shift that must occur to become your own banker. You have to remove your focus from earning the highest “rate of return” and start targeting leverage and cash flow.

The chasing rate of return is for those who throw money into a 401k, look at their statements quarterly, and hope for the best. Real estate investing and business ownership is taking back control of your life, your finances, and your future. Strategically planning so that you have a financial toolbox with multiple types of tools to accomplish all the different jobs that come along. Walking around with a toolbox full of just hammers is fine and dandy until you need to cut a piece of wood in half. Life insurance, when done correctly, can be a true diversification, tax-sheltered, lifetime income stream asset.

These policies are just a tool used to warehouse dollars that can be used to go invest in deals while they still earn interest within the account. In addition to maintaining the compound interest curve, tax deductions reduce liabilities today while the cash value growth generates tax-free income later on. Of course, as owners of businesses and real estate, there is also an asset protection piece that plays a major role in self/company preservation. Peeling back the layers allows us to see the inner workings of each policy but more importantly, understand how implementing the strategy springboards cash flow and financial independence.

There are so many valuable benefits to owning this asset, but for now, we are going to focus on the four foundational elements that create the true prosperity we are all searching for. When properly designed and implemented, Infinite Banking will lower taxes, increase leverage, increase control, and lower risk, enhancing your business and creating a legacy for generations to come.

I.Lower Taxes

People who invest in real estate are usually already mindful of tax deductions and how to use depreciation and expenses to offset income. Utilizing Infinite Banking creates another itemized deduction write-off through the loaning strategy. As previously mentioned, the life insurance policies warehouse dollars that can be used to invest in real estate.

Accessing the cash within the policies can be done through a withdrawal or a loan. Most “be your own bankers” will access their money by taking a loan against their policy. We’ll discuss the leverage aspect of the policy loans later on but in lowering tax liability today, IBC still plays a role.

The loans taken against the cash value of the policy do have an interest rate attached to them. However, the interest paid to borrow the money is considered a business expense and can therefore be written off on taxes. The loans are tax free as well. For example, if there has only been $100,000 contributed over time and the cash value has increased to $175,000 with growth, the owner could take out $150,000 (or more) without paying taxes, even though $50,000 of what is being access has never been taxed! If we are going to leverage money to invest in real estate, why not do so in a way to increase our tax savings? For consideration in later years, life insurance is treated as a FIFO (first in, first out) asset. The money that has already been taxed and is saved into a life insurance policy will be the first money paid out when distributions are made in retirement years.

This means taxes are not paid on any of those dollars during the years they’re taken out. The true benefit is when the growth can achieve Roth status as well. Retirees using their policy values as cash flow will not be taxed on their withdrawals the entire time up to basis (the amount they actually contributed).

This usually lasts for years into retirement. Once the basis has completely been withdrawn and only the growth remains, the ongoing policy distributions are then distributed as loans. Again, yes these loans do carry an interest rate however, at this stage of the policy the internal growth and dividends are higher so they are able to sustain policy growth (if not continue to increase it) even while paying the interest on the loans, so no costs come from the policy holder’s pocket. This asset helps investors increase returns in working years, but turns into a tax free, guaranteed growth, retirement income MACHINE in later years.

Taxes do not tend to go down and definitely do not go away, so saving money strategically will allow for lower taxes now and later creates relief for individuals as well as their families. Because Infinite Banking utilizes a life insurance policy, the death benefit pays out 100% tax-free to beneficiaries.

This treatment from the IRS has been taken advantage of by the financially savvy for decades. It is how the wealthy are able to pass wealth from generation to generation without being eaten up by income & inheritance taxes each time.

In the book “What would the Rockefellers do?”, tax-efficient estate planning is backdated and applied to some of the wealthiest families our country has ever seen. Both the Rockefellers and Vanderbilt’s were titans in the early 1900’s. However, today the Rockefelllers have not just maintained their wealth but exponentially grown it, while the Vanderbilt family doesn’t have much left to their name other than the University in Tennessee. This book compares the differences of how each family handled estate planning and passed along generational wealth. It is a quick and easy read and helps lay the foundation for a generational mindset, but more specifically, a tax-free generational wealth.

II. Increase Leverage

Leverage is an incredible tool. I love to work out and consider myself a strong person but I, as well as most other normal human beings, are incapable of picking up their own vehicle off the ground. However, by using a small metal tool, weighing an average of 3-5lbs (for those who don’t like to infer I am referring to a car jack), any person can use the power of one arm or leg to easily raise and hold a vehicle off the ground.

It is the same concept as using a flathead screwdriver to pop open a paint can lid or a crowbar to pry back dense metal. The list goes on and on. The point is, leverage is about the utilization of a tool to do a job that would otherwise be considered very difficult, if not impossible.

Infinite Banking policies create that same leverage within our financial lives. Policy loans have been referred to a few times so far, so let’s dive a little deeper. Most people in real estate save money into an account to earn interest then take the money out to go invest in whatever opportunity arises.

This is a great way to use the money, but there is an opportunity cost associated with the transaction. When the money is taken out of your account to be invested in a deal, the money can no longer earn interest within the account. Yes, it is supposed to earn interest through whatever you’ve invested in which is great, but what if you could use your money to invest in real estate, while that same money continued to earn interest within the savings account as well?

Said another way, what if you could enhance the returns you’re already receiving through real estate investments to create more cash flow? When loans are taken out against the cash value of a policy, they are considered “non-recognized” (if you use an insurance company that has non-recognition loan options).

Most accounts recognize when money is taken out, therefore causing future interest to be lost. For example, in a traditional savings or investment account with a value of $150,000, when $100,000 is taken out to invest in deal “XYZ”, the savings account is now only crediting interest on the $50,000 that remains. Of course, the $100,000 is out-earning whatever that deal produces but let’s see how an Infinite Banker would transact in that same scenario.

Instead of taking the money out directly, a strategic banker would take out a loan for the $100,000 to invest in the deal “XYZ”. Because the loan is not recognized against the policy value, the $100,00 is getting whatever IRR the real estate deal provides while the entire $150,000 account value continues to earn interest! Robert Kiyosaki (author of “Rich Dad, Poor Dad”) talks about giving one-dollar multiple jobs and this is a perfect example. You are literally allowing your money to go invest in real estate while it continues to earn interest within the savings account.

Earning multiple rates of return at the same time is a springboard to doing more deals sooner. Now lets address the elephant in the room. You have taken out a loan against the policy meaning the money has to be paid back with interest. For those who have followed me prior to this article, I previously covered the difference between compound interest and amortization in my “Save Up vs. Spend Down” blog. If you haven’t read it, I highly suggest at least a quick read-through as it covers in detail the same scenario that occurs within this loaning strategy.

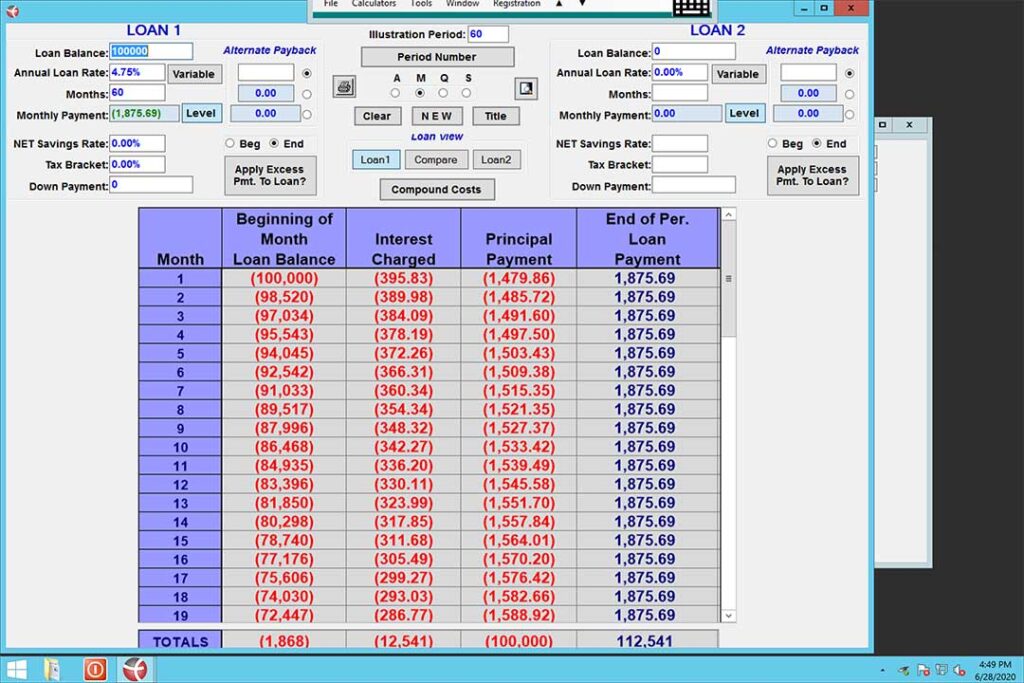

We must understand the difference in amortization vs. compound interest to be a successful “banker”. Shown below in Table 1 is a sample amortization table for an investor who is loaning out $100,000 to invest in a multi-family deal that plans to disburse in 5 years. The loan is taken from the insurance company and carries a 4.75% interest rate (this is a current rate taken from one of the top Infinite Banking Insurance Companies).

The loan setup through the insurance company varies slightly from this calculation example (they’re usually simple interest loans, payments are flexible, etc.) but the general idea stays the same. Over 5 years $12,541 is paid in interest. This is where some people get hung up. They cannot get past paying interest on a loan when the cash is readily available. You could absolutely take the cash out and invest in RE directly but you would lose the future value of the interest earned on that money.

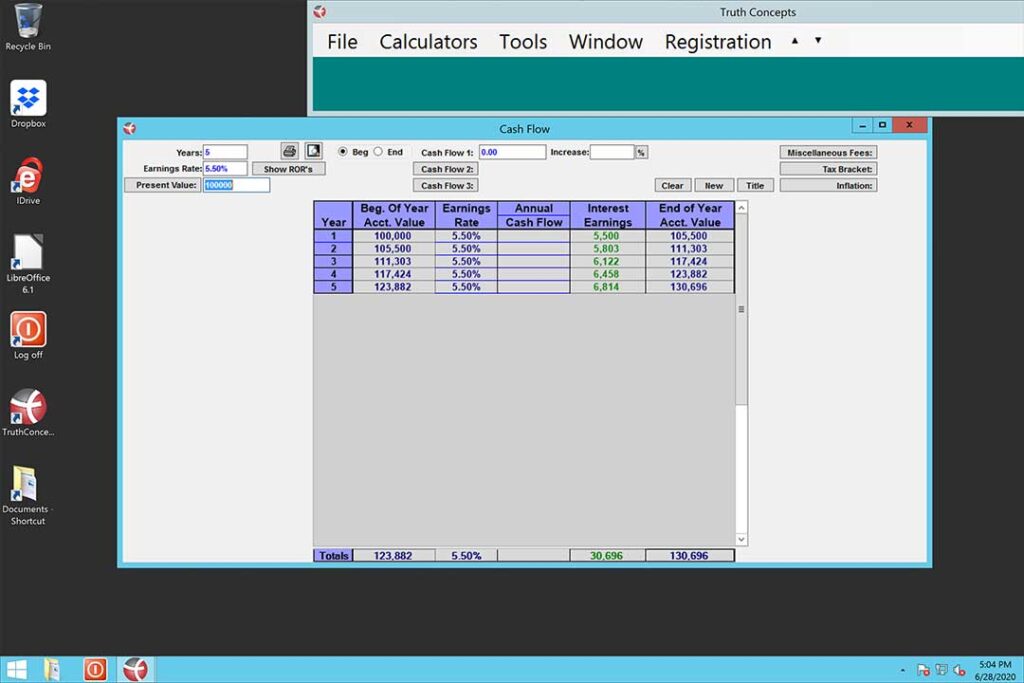

Being short-sighted leads to giving up future dollars earned by not understanding leverage. Table 2 is an example of what is going on within the policy while the money is loaned out. The $100,000 has been earning interest for the last 5 years at an assumed 5.5% (I am using low and reasonable growth rates as my own personal IBC life policy earned 7.89% last year with interest and dividends). The same $100,000 that the investor