In grade school, I remember riding my bike down the street, through the gully and up to the 7 Eleven. I could take a dollar bill, walk out with a handful of bubbalicious bubble gum and proceed to put as many in my mouth as possible to create the largest bubble ever. Also, growing up in a family of 5 kids we went through plenty of bread, milk and cheese.

Every Sunday after church my mom would pull up to the corner store, give me 2 $1 bills so I could run in to get a gallon of milk and she always expected change. It’s fair to say those scenarios don’t exist in our world today. I’m sure now I sound like a cranky old lady because my husband and I are both mentally decades older than our physical age which can be considered a blessing and a curse.

But surely I’m not the only one who gets caught off guard by what life costs in general anymore?! Anyway, complaining aside there is a reality that is often underestimated when planning for the future which causes a compounding effect of difficulty later on in life. Inflation is often not taken seriously either due to a lack of understanding or sometimes as a defense mechanism against the mental and financial struggle of planning for increasing income later on.

Regardless, there are multiple myths that have obscured expectations for costs in 10, 20, even 30 years down the line. Most or all of these myths are brought into conversations when planning future income generation. In order to prepare effectively, we must debunk false beliefs and consider the facts.

Myth 1: Inflation ranges within the Fed’s target of 2%

This calculation is a tricky one. Inflation is a very broad term that calculates costs over a variety of time and industries. Housing price changes will differ from the cost of gasoline which will be different than price changes in the medical field. Below is a chart that identifies various sectors within the European region and the affiliated CPI for each since 2000.

Obviously, this information is not specific to the United States for the average inflation rate HOWEVER, we are able to see there are significant variances in price increases between different sectors. In recent years healthcare has taken over as champion of inflation rate. According to www.healthsystemtracker.org “On a per capita basis, health spending has increased over 31-fold in the last four decades, from $355 per person in 1970 to $11,172 in 2018. In constant 2018 dollars, the increase was about 6-fold, from $1,832 In 1970 to $11,172 in 2018”. The point is a blanket generalization for the inflation rate can be misleading so be aware of specific changes within areas that impact your life the most.

In all honesty, it is too time consuming and complicated to factor every inflation rate for every single sector of our economy into a financial plan, so an average inflation rate is a useful rule of thumb to at least get us started. But if we’re going to use averages, we at least need to use relevant data to calculate the assumptions. It is a widely believed myth that our national inflation rate hovers around 2% as the Federal Reserve states that rate to be their target.

I’ve also seen reports and plans built on inflation data ranging from the early 1900’s to now. The problem is, these assumptions are not being brought into current context and are therefore irrelevant. The definition of inflation is “a general increase in prices and fall in the purchasing value of money”. The value of anything is based on the difficulty or the ease in obtaining it. My husband loves cashews which happen to be the #5 most expensive nut to buy on the top 10 list. After watching a documentary of producing and harvesting cashews (because that’s the kind of things I do in my free time 😊), I have vowed to never gawk at cashew prices again.

These nuts are incredibly difficult and actually dangerous to process so whatever farmers choose this crop are working hard for their money! Circling back, ever since we as a country severed the link between the dollar and gold reserves back in 1971, printing money could be considered an extreme sport for the Feds. Access to our dollar and the availability of funds in the hands of citizens has skyrocketed causing a domino effect of buying the same goods/services with the now more available money.

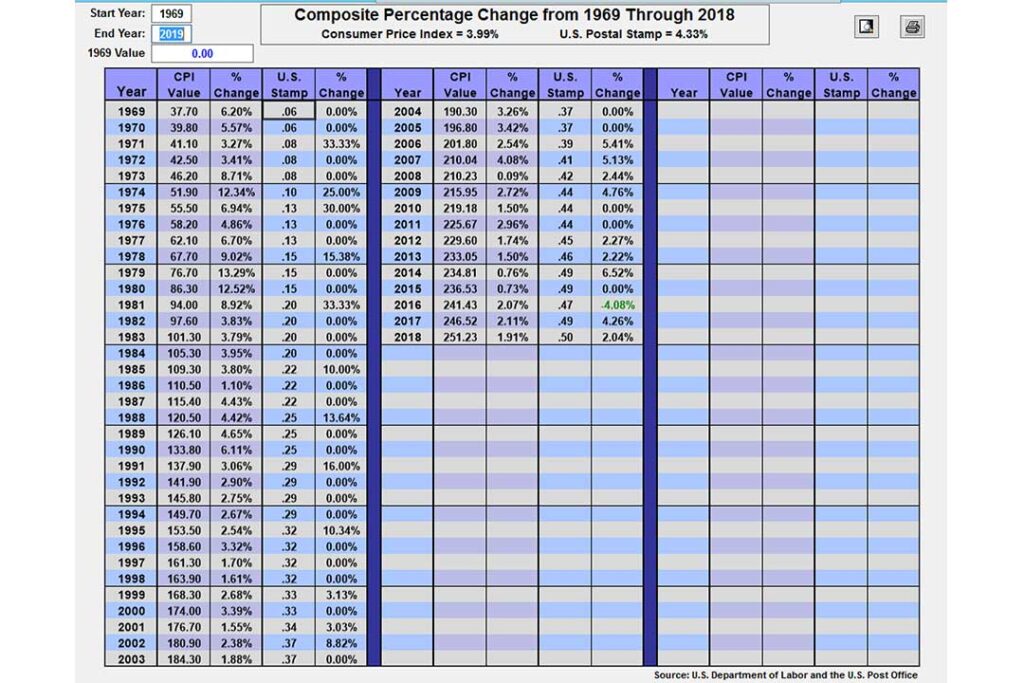

When we actually review the CPI (consumer price index) based on a relevant time frame of not being tied to gold reserves since the 1970’s, the average inflation rate is almost double at 3.99%. Speaking in terms of income, if someone is planning to live on $75,000 a year based on a 2% inflation rate, they will actually need $110,000 per year to feel the same within a 4% inflation rate. Expecting $150,000 for income within a 2% inflation means you’ll actually need $220,000 assuming 4%. These small changes over a long period of time have a massive impact on dollars saved and spent. The chart also highlights that inflation is not steady and we do not typically see gradual increases every year.

There is a spontaneity within overall costs that isn’t necessarily predictable but can have leading indicators. Going back through history, there are dull times of low rates then there are economically rough times and periods of monetary stimulation by the Feds that are routinely followed by hyperinflation. Just to be clear, we have seen over $2 trillion (yes, that is spelt correctly with a “t”) in stimulus funds this year alone so you can make your own predictions about inflation rates to come.

Myth #2: I’ll have my debts paid off in retirement so I won’t need as much

My first credit card was a Walmart store card which came in handy multiple times (too many times if we are being honest) throughout college. After realizing my mistakes and getting my act together like a responsible adult, I managed to pay that sucker off. The relief I felt and the burdened lifted from my chest is a feeling I will never forget. I get it, removing obligations from dangling over your head like a dark cloud is satisfying and could even be considered addicting. But there is a misleading message being communicated to the masses through these financial guru guys on the radio that paying off your debt relieves you from other financial responsibilities.

There are so many people focused in on paying extra to their mortgage to pay it off sooner and save their selves from the 3.5% interest rate they are locked into. They may end up saving a few thousand dollars of interest by paying over on mortgages, cars or student loans. But anyone paying over on debts with low interest rates is paying the largest price of all. Time lost. Money only does one of two things: earns interest or loses interest. And the time lost to earn interest can never be recouped! For example, if I go buy a car for $20,000 cash and drive away, did I pay any interest for my vehicle? No. However, let’s consider the $20,000 cash that I gave to the car dealer.

Will it ever earn ME interest in the future? No. So when I pay $20,000 cash to avoid paying interest on the car, I lose the ability to invest the $20,000 and earn more interest than I would’ve ever paid on the car by taking out a loan. Paying debt is not our biggest mountain to climb in life, we should be focused on earning interest on our money.

We attended a party for a church friend that was a “birthday/mortgage payoff party” last year. Among the chatter around the punch bowl, the homeowner, Bob, was asked by an enthusiastic guest, “how does it feel to have your mortgage paid off?”. Surprisingly, Bob shrugged while staring into his paper cup and replied, “Well over the last 30 years my utilities and taxes have become more than double the mortgage payment, so I haven’t event really noticed”. Of course, that was a mood killing answer but it was an honest one! I agree that the idea is to gradually have expenses go down throughout our career but we must reveal one vital flaw in most people’s future planning…YOU CANNOT PAY OFF THE COST OF LIFE.

It is impossible. There are always expenses and bills to pay. Mortgage gets paid off, we still have taxes, insurance, utilities, maintenance, etc. The car is paid off but is has 120,000 miles on it and it still need registrations, inspections, gasoline, repairs, etc. The kids are out of the house, but they tend to bring back more in the form of grandchildren. I don’t have any grandchildren of my own but they seem to be almost expensive as regular kids. Overall, realistic expectations are the foundation to proper planning.

Not just in the growth opportunities for our savings, but the generation of adequate income to cover expenses. I’m not saying paying off debt is bad so don’t misread this message. However, if all funds are focused on paying down debt, accumulation is put on the back burner. You could focus on debt reduction in order to head into retirement with only $30,000/yr in expenses and $50,000/yr in income. Or if you are ok with managing responsible debt, you could have $50,000/yr in expenses while generating $100,000/yr in income. There is no wrong answer, but understanding the difference is the key to successful planning.

Myth #3: I’ll be old in retirement and won’t want to go anywhere so I don’t need as much

I am so blessed with opportunities and achievements that allow me to run my own business and do something that I love every day. I truly enjoy going to work and talking with people. But I definitely enjoy my weekends too! In all reality, I work in some way, shape or form every single day. That fact just comes with the entrepreneurial life. But the weekends are a time to focus more on recreational activities, family and friends. I think most people fall into the same weekly routine, so let’s make a financial consideration based on that scenario.

Do you typically spend more money throughout the week or on Saturday? I personally lean more toward the latter. Yes, everyone’s plan in retirement looks different. Some want to sell everything they own and travel the world. Others want to sit at home, relax and tend to their tomato plants. Either way, every day is Saturday in retirement. Extroverts will be ready to paint the town every day with their friends living the social life. More introverted folks will be hunkered in with their books and Netflix.

As human beings, we are likely to spend more money because we have more free time. This 2020 quarantine has proven that even not leaving the house poses a threat thanks to Amazon and Facebook ads. Outside of the basic cost of life increasing like we’ve already discussed, miscellaneous spending has to be budgeted within a financial plan as well. It’s not the large purchases of a house or cars that usually cause problems. It is the sum of all the small purchases along the way that are the silent killer.

Moving away from the fun aspects of all the freedom we’re looking forward to enjoying in retirement, most families have experienced the struggle of morbidity that comes in the later years of life. We can divide our elder years into three general stages:

1. The “go-go” years

2. The “slow go” years

3. The “”no go” years”.

Stage 1 is composed of living this new life to the fullest. New retirees are still young and spritely enough to have ambitions. These are all the white haired, bright eyed folks we see on retirement brochures and prescription commercials. Those people are taken advantage of retirement to partake in the activities and adventures their working life prevented for so many years. Obviously, this stage is where a significant amount of money can be spent.

Next, we have the “slow go” years. At this point in life we tend to become more tired, laid back and sometimes even more physically crippled which prevents being motivated to get out of the house. There were many sick days from school I enjoyed with my grandma who happened to be in her “slow go” years. These days were spent with Bob Barker on the “Price is Right” and the entire cast of “The Young & The Restless”.

This can still be an enjoyable time of life and the good news is, less money is usually spent throughout these years. Lastly, we enter stage 3. At some point our bodies or our minds (sometimes both) begin to deteriorate. This phase is where the bills can really start to stack up. Physical ailments result in surgeries, prescriptions, physical therapy, doctors visits and equipment which can all take a financial toll on anyone (especially considering that healthcare industry has the highest inflation rate at over 6%).

Mental deterioration is even worse. Females are naturally more susceptible to Alzheimer’s and dementia, but it is also considered genetic. This particular ailment has plagued my family and the even the strongest of people can barely muscle through. Most Alzheimer and dementia patients end up needing a full-time caregiver and/or move to a full-time care home. These facilities are great and the aides are incredibly helpful, but these services are not provided for free.

In Texas, the median price for a shared room is about $51,00/year. For a private room, it costs about $68,000/year. Considering most Alzheimer’s patients live for 8-10 years after diagnosis, the bill for care adds up quickly. Long term care policies are an invaluable tool in hedging against the risks of costs for mental or physical ailments. Of course, these policies need to be structured correctly and issued through a reputable company but that is a different conversation for another day.

Dreams and aspirations are vital pieces to our lives and help us paint a mental picture of why we work hard every day. But if action steps are not thought out and implemented, those dreams will never be released from our brains to become reality. Even if the most detailed and thorough of processes and procedures are mapped out to achieve your goal, problems and failure can seep through the cracks when proper assumptions are not included in the plan.

Myths are great entertainment to use as a tv show tracking ghosts or busting with science. But when it comes to financial planning and creating your own independence, its best to use factual evidence and accurate data calculations. The cost to live will never go away. But understanding what we’re up against for inflation, how to manage savings and what to expect for future spending will lay a solid foundation to build upon throughout your career.